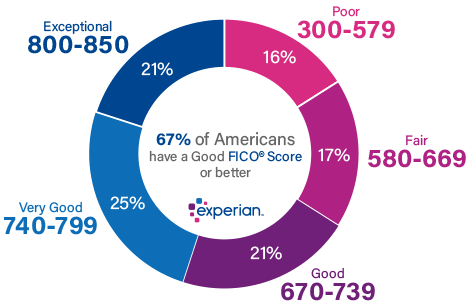

When applying for an available rental, Stars & Stripes Homes, Inc. checks your Credit Score via Experian. That's what our homeowners expect and that's what we do. Questions? Ask the Property Manager who is managing the home you are interested in. Below is a little more info on the credit score. Renting out your home? Contact me now, our inn is full and we need quality homes for our well-qualified tenants! We are a full-service company, so if you are interested in selling your home, we can do that also!

Experian uses VantageScore 4.0, a credit score developed by the three national credit reporting companies (CRCs) — Experian, TransUnion, and Equifax. The VantageScore uses only one model with one set of scoring calculations, resulting in scores that are more uniform across all three CRCs.The VantageScore 3.0 model is used as a risk score, which is a key component that we use to determine creditworthiness.

Like the system or not, your credit score is a 3-digit code or score derived from an algorithm that can play a significant role in your ability to obtain credit (auto loans, mortgages, credit cards, etc.) and determine the interest rate you will pay for credit, or perhaps influence an owner's decision to rent their home to you.

According to Experian, the average credit score in the United States is approximately 710.

Research shows that renters are now less likely to be evicted or skip out on their leases thanks to improving economic conditions in the U.S., according to a new report from TransUnion. This particular report shows that renter risk decreased by 2% year-over-year as 34% of renters now have renter scores of 720 or higher. The score is based on a TransUnion proprietary scoring method.

According to TransUnion, landlords can thank a strong economy and low unemployment levels for the rise in renter dependability.

When property management companies are steady on their accept or decline criteria, they are declining fewer applicants and the population they are accepting is expected to perform better.

Here at Stars & Stripes Homes, Inc, we check your FICO score when you apply for an available home for rent. Again, it's what our homeowners expect and that's what we do.